Home / Blog

News & Blog Articles

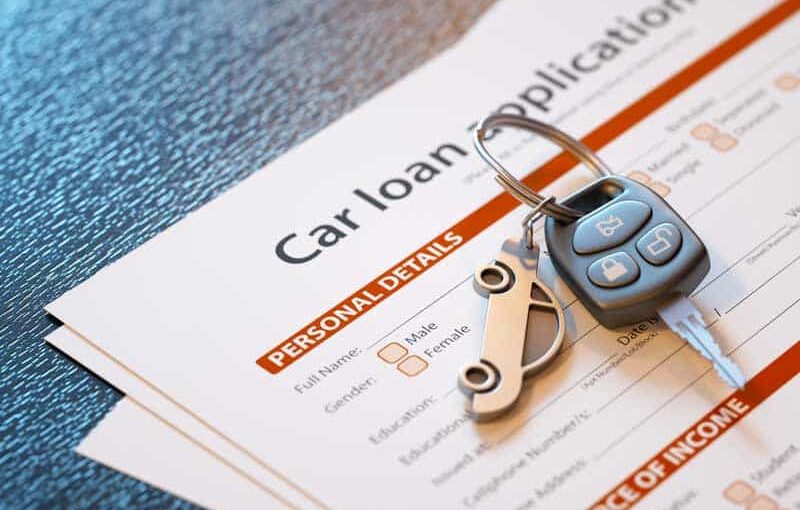

Car loan requirements: What do you need?

By aussiecarloans.com.au / 26 Jul 2024

Guide to Buying Cars Online

By aussiecarloans.com.au / 25 Jul 2024

Car Loan Approval: How long does it take?

By aussiecarloans.com.au / 22 Jul 2024

Benefits of Using a Finance Broker

By aussiecarloans.com.au / 21 Feb 2024

How To Get A Car Loan Even With Bad Credit

By aussiecarloans.com.au / 09 Oct 2023

Improving your Credit Score for your Car Loan

By aussiecarloans.com.au / 09 Oct 2023

8 Reasons to get a business car loan

05 Oct 2023

Low Doc Car Loans Are Perfect For Small Business

If you are a small business owner or self-employed individual, you might find it difficult to access certain financing options due to your financial history. The good news is there’s a loan option that can help you achieve your goals—a low doc car loan.

19 Sep 2023

Car Loan Interest Rates Explained

15 Aug 2023

A Comprehensive Guide to Buying a Used Car in Australia: Tips, Rights, and Avoid...

Buying a second-hand car is ideal if you’re on a tight budget. You’ll get a great vehicle without spending too much. However, finding a good used car requires a lot of due diligence. You can’t just choose one and drive off. A lot of thought must be put into your second-hand car purchase.

11 Jul 2023

Buying a Used Car: Prioritizing Safety and Affordability

If you want to buy a car without going to a dealership, purchasing a car privately is the way to go. As a buyer, private car sales can help you get a better deal on your vehicle.

04 Jul 2023

Used Car Safety Ratings: Your Guide to Choosing a Safe and Reliable Vehicle

If you want to buy a car without going to a dealership, purchasing a car privately is the way to go. As a buyer, private car sales can help you get a better deal on your vehicle.

03 Jul 2023

Buying A Car Before Tax Time

01 Jun 2023

Car Loan Comparison Rates

A loan comparison rate is an indicative interest rate that combines the nominal interest rate with foreseeable fees & charges associated with a car loan.

09 May 2023

What are Balloon Payments?

In this article we explain the term 'Balloon payment' on your car loan and how it will affect your loan repayments.

09 May 2023

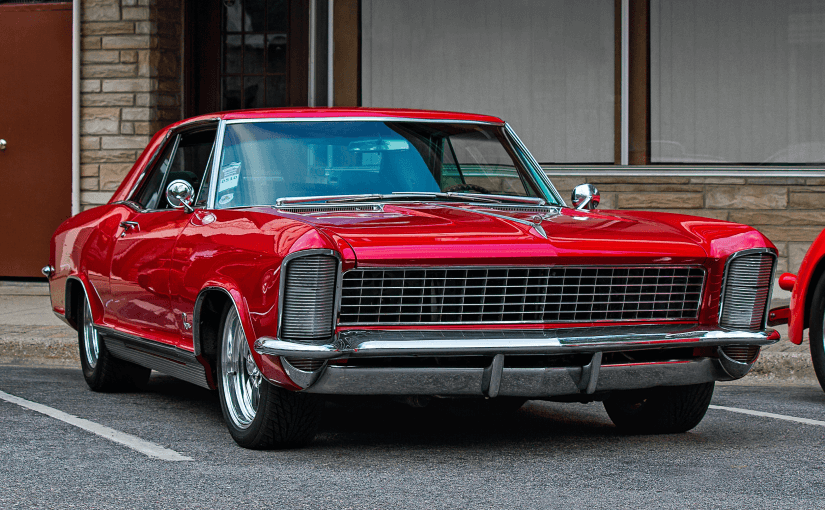

Popular Classic Cars to Spice Up Your Life

Australians still love the appeal of classic cars. The value of classic cars in Australia is steadily on the rise & experts believe it is set to accelerate.

24 Apr 2023

Cars that can appreciate and make you money

The classic car market is going at full speed right now. If you are on the lookout for a profitable investment, then hop in.

24 Apr 2023

The best Australian-built cars (Classic, Vintage and Muscle) pre-1980s

As a casual worker, you may have to pass a few extra requirements and go through additional steps. But it’s nothing too complicated. In this guide, we outline everything you need to know to get a good car loan while casually employed.

24 Apr 2023

Classic Car Investment: A Guide

Classic cars are vehicles that are 20 years old or older. They’re lauded for their craftsmanship, style, and innovation that reflect the era they were made in. Some classic cars are so valuable they could fetch over half a million dollars, and the rarest cars are valued even higher.

24 Apr 2023

0% Car Finance – What’s The Catch?

Nowadays, new car finance deals are a dime a dozen each promising to save you the most money. You’ll find plenty of 0 percent finance car deals in Australia that may sound great, but are they really the best car loan out there?

23 Mar 2023

Private Car Finance: Buying A Car Privately

If you want to buy a car without going to a dealership, purchasing a car privately is the way to go. As a buyer, private car sales can help you get a better deal on your vehicle.

09 Mar 2023

Top Reasons To Get Your Car Loan Pre-Approved

Discover the benefits and process of getting a pre-approved car loan in this informative article. Experts highly recommend this step when seeking car loan approval advice. Learn why it's so essential and get all the information you need to make an informed decision.

09 Mar 2023

How to Get a Car Loan on a Casual Income

As a casual worker, you may have to pass a few extra requirements and go through additional steps. But it’s nothing too complicated. In this guide, we outline everything you need to know to get a good car loan while casually employed.

02 Mar 2023

Credit Score Required for a Car Loan

Understanding credit scores, knowing what they are and how they’re determined, and how you can improve them is key to getting a good car loan. Let’s demystify credit scores and get you one step closer to buying the car of your dreams.

02 Mar 2023

The Future of Diesel in Australia

Diesel cars are everywhere on Australian roads. From SUVs to 4X4 off-roads trucks to utes, you’ll find plenty driving around—you might even own a diesel car yourself. Diesel engines are popular because of their size and power offering more torque and are more fuel efficient.

20 Feb 2023

The 5 Best Cars for Ride Sharing in Australia

Uber and other rideshare services have quickly become commonplace among commuters. Because of rideshares’ huge popularity among Aussies, a lot of people want to capitalise on it and become drivers themselves.

16 Feb 2023

Top 10 Affordable Sports Cars in Australia

Motorists in Australia are spoilt for choice when it comes to sports cars. Aside from the typical high-end luxury brands, you can also find sports cars from a host of manufacturers that are affordable but still reliable.

14 Feb 2023

How Car Loan Interest Rates Work

28 Jul 2022

5 Car Hacks That Will Make Your Life Easier

20 Jul 20224 More Cool Car Hacks

20 Jul 2022

We’ve Had A Makeover. Didn’t You Notice?

12 Jul 2022

Rising Fuel Costs Making Hybrids More Attractive

12 Jul 2022

Are Your Interest Rates Competitive?

12 Jul 2022

What does Aussie Car Loans have to offer?

12 Jul 2022

Can I Buy A Car Privately Or From A Dealer?

12 Jul 2022

Car automation – how far will it go?

12 Jul 2022

The family car goes solar

12 Jul 2022

Make Way For The Smaller Car

12 Jul 2022

How the 2018 Budget Will Affect Motorists

12 Jul 2022

Finding the Best Car Loan

12 Jul 2022

Personal or business finance?

12 Jul 2022

Aussie Road Trip Holiday Survey

12 Jul 2022

I’ve Got A Bad Credit Rating?

12 Jul 2022

Where’s My Flying Car?

12 Jul 2022

What The Small Business Tax Breaks Mean For You

12 Jul 2022

That First Car

12 Jul 2022

Secured Personal Loan?

12 Jul 2022

Are There Car Loan Application Fees?

12 Jul 2022

The Future Is Coming… Now!

12 Jul 2022

Unsecured Personal Loan?

12 Jul 2022

VW Takes Fuel Efficiency To New Level With XL1

12 Jul 2022

Mazda6 Touring Sedan wins Best Car Award

08 Jul 2022

Should You Buy an Electric Car?

By aussiecarloans.com.au / 08 Jul 2022

Buying A Car In 2017

08 Jul 2022

11 Things You Should Keep In Your Car

08 Jul 2022

Grey Nomads on the rise

08 Jul 2022

Is the Australian New-Car Market Recovering?

08 Jul 2022

Best Ways to Save Money on Your Car

08 Jul 2022

Employment Opportunities

08 Jul 2022

Best Time To Buy A New Car

By aussiecarloans.com.au / 08 Jul 2022

Toy Show or Car Show – What’s The Difference?

08 Jul 2022

Tips for Maintaining a Good Credit History

By aussiecarloans.com.au / 08 Jul 2022

car-dealer-insurance-crackdown

08 Jul 2022

Three DIY Car Repairs Everyone Should Know

08 Jul 2022

Life imitating art, or is it art imitating life?

08 Jul 2022

ŠKODA – From bikes to cars

08 Jul 2022

Car Hacks To Make Life Easier

08 Jul 2022

Traffic Jams, Car Colours and… the Batmobile

08 Jul 2022

Hyundai’s Latest Offering: The i30N 2017

07 Jul 2022

That first lesson…

07 Jul 2022

The Latest Batch of Electric Vehicles

07 Jul 2022

The Perfect Car For Mr & Mrs Bond

06 Jul 2022

10 Cars to keep an eye on in 2020

06 Jul 2022

Spring Cleaning Your Car

06 Jul 2022

The Flying Car Is (nearly) Here

06 Jul 2022

5 Tips For Buying A New Car

06 Jul 2022

Cars, Cars, Cars… Whenever You Want Them

06 Jul 2022

Economical Cars & Paris Bans Old Cars

06 Jul 2022

How Do I Lease A Car?

06 Jul 2022

Car Loan Approval Tips

06 Jul 2022

How is Fuel Economy Tested?

06 Jul 2022

Avoid Dealership Traps & Drive Out A Winner

06 Jul 2022

The 2018 Paris Motor Show

06 Jul 2022

Aussie Car Loans Radio Ads

06 Jul 2022

Buying That Car

06 Jul 2022

What are my chances of approval?

01 Jul 2022

Should I Buy or Lease a Car?

01 Jul 2022

Novated Leasing Myths Debunked

01 Jul 2022

Strangest Car Accessories & Gadgets

01 Jul 2022

5 Winter Road Trips Across Australia

01 Jul 2022

What Makes a Cheap Car Loan?

01 Jul 2022

Some Great Finds At Car Auctions & On eBay

01 Jul 2022

Off-Roading Tips For Beginners

01 Jul 2022

Any colour you like, as long as its black

01 Jul 2022

8 Romantically Cheesy Car Ads

01 Jul 2022

5 Best Upcoming Vehicles in Australia for 2019

01 Jul 2022

Dashcam Recommendations 2018

01 Jul 2022

You’ve Got A $10K Budget For Your Car

01 Jul 2022

Wards 10 Best Engines of 2019

01 Jul 2022

The Cost Of Parking In Sydney

01 Jul 2022

Official State Cars

01 Jul 2022

To Lease Or Buy A Car?

01 Jul 2022

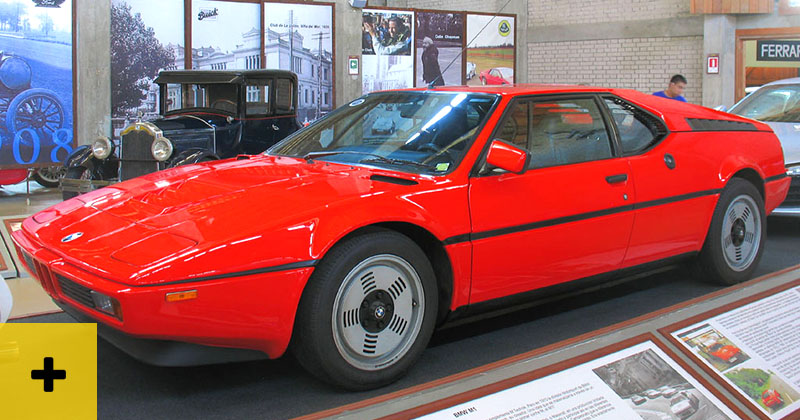

BMW M1: The Forgotten Supercar

01 Jul 2022

Dash Cams in Australia

01 Jul 2022

A Beginner’s Guide to Car Tyres

01 Jul 2022

Dealer Extras: Yes Or No?

01 Jul 2022

Buying A Car At Christmas

01 Jul 2022

What’s Old Is New Again

01 Jul 2022

What Is Car Depreciation?

01 Jul 2022

Rallying For A Cause

01 Jul 2022

A 5 Step Guide To Obtaining Car Finance

01 Jul 2022

Most Expensive Cars of 2017

01 Jul 2022

Steam Power, Anyone?

01 Jul 2022

Preparing Your Car For A Summer Road Trip

01 Jul 2022

Why Have Fuel Prices Been So Cheap?

01 Jul 2022

Australia’s Best Scenic Drives

01 Jul 2022

10 Games To Play In The Car

01 Jul 2022

The Kia Stinger 2018

01 Jul 2022

That New Car Feel

01 Jul 2022

When to Sell, Swap or Upgrade Your Vehicle

01 Jul 2022

Best & Worst Green Cars

01 Jul 2022

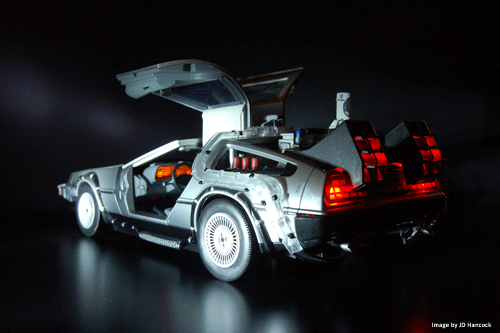

Famous Movie Cars

01 Jul 2022

New Hilux & Ranger Competitor – LDV’s T60

01 Jul 2022

The Best Ways To Prevent Car Theft

29 Jun 2022

Overtaking a Cyclist: New NSW Legislation

29 Jun 2022

How To Get A Loan For An Imported Car

27 Jun 2022

9 Must-have Features for Your Car

27 Jun 2022

What does your Car Insurance Cover?

27 Jun 2022

Buying A New Car Versus A Used Car

24 Jun 2022

Do Car Loans Help Your Credit Score?

24 Jun 2022

How long does it take to get approved?

24 Jun 2022

Buy A Used Car With Confidence

24 Jun 2022

Things You Should Never Do To a Brand New Car

24 Jun 2022

How much does your car cost to run?

24 Jun 2022

Ready To Drive A V8 Supercar?

24 Jun 2022

Beaut Utes: A History Of The Australian Ute

24 Jun 2022

Old Mustang Vs New Mustang

24 Jun 2022

Vehicle Review: Subaru XV (2018)

24 Jun 2022

Car Review: New 2019 Mazda 3

24 Jun 2022

Secured Vs Unsecured Loans

24 Jun 2022

How to Reduce Your Car Loan Repayments

By aussiecarloans.com.au / 24 Jun 2022

Pros & Cons of Buying an Ex-Demonstrator Vehicle

24 Jun 2022

Why Regular Vehicle Maintenance is Important

24 Jun 2022

How Does Car Finance Work?

24 Jun 2022

What Tax Deductions Can I Claim on my Car Loan?

24 Jun 2022

Top Five Best Selling Cars in Australia and Why

24 Jun 2022

How to Pay Off Your Car Loan Faster

23 Jun 2022

Luxury Car Tax Explained

23 Jun 2022

What Is Refinancing A Car Loan?

23 Jun 2022

A Step-by-Step Guide to Getting a Car Loan

23 Jun 2022

Tips on How to Save Up for A New Car

23 Jun 2022

Lease vs Hire Purchase

23 Jun 2022

Stamp Duty Explained

23 Jun 2022

Affordable Drift Cars for Beginners

23 Jun 2022

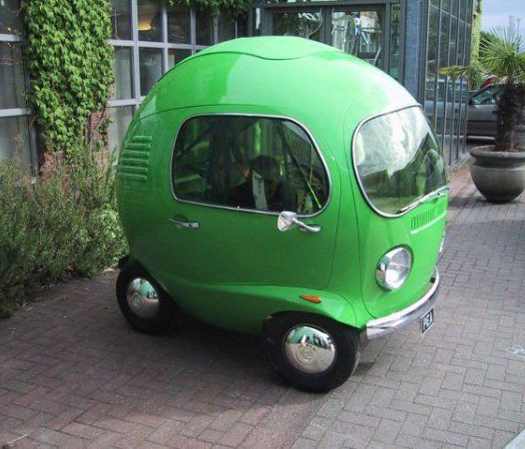

The Bubble Car

23 Jun 2022