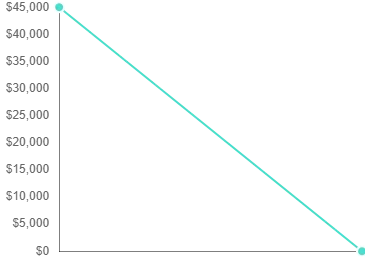

Get an idea of what your car loan repayments* will be and how much you can borrow with our easy to use car loan repayment calculator!

Whether you're financing a new or used car, simply type in the amount of the loan, the interest rate (e.g. 5.97%), select your frequency of repayments (weekly or monthly) and select the length of the loan (your loan term). If you will be paying a balloon amount then you can include this too.

Take the guesswork out of your car loan application with a car loan calculator. No more wondering about the best repayment frequency, how interest and a balloon payment will impact your loan, and so on. Calculate your car finance repayment easily and find ways to save on your car loan.

Use a car loan calculator, also known as a car repayment calculator or vehicle finance calculator, to see an estimate of the total cost of your repayments during the lifetime of the loan. Adjust the car loan calculator’s parameters (loan amount, vehicle price, loan term, etc) and see how it affects your car finance.

Check out the car loan repayment calculator below to see your loan repayment options.

How to use a car loan calculator

The car loan calculator is pretty straightforward. All you need to do is input the needed information and you’ll see the results instantly. You can change the data whenever you want and see if the results fit your needs.

Follow these steps to calculate your car loan repayment estimate using the car loan calculator:

- Enter your ideal loan amount

- Enter your vehicle purchase price

- Choose your preferred loan term (Anywhere from 1 to 7 years depending on the lender)

- Enter the interest rate

- Enter the balloon payment percentage

- Choose the repayment frequency

- See the summary results

Modify the calculator to see how changing the loan amount, vehicle price, repayment frequencies, and term loans can affect your total car loan repayments.

Why use a car loan calculator?

A car loan calculator is a quick and easy way to estimate your car loan repayments. Calculate your potential car loan repayment expenses before you even apply or pre-apply for a car loan.

With the car loan repayment calculator tool, you can get more information about which loan option may suit your current financial situation. Other advantages of using a car finance calculator include:

- Help you budget properly. The car loan calculator provides helpful estimates so you can plan your finances accordingly. Even before taking out a loan, you’ll have an idea of how much your repayments may be.

- Save time and money before applying for a car loan. You can compare loans from different lenders by inputting their advertised interest rate and your preferred loan amount, vehicle price, and balloon payment.

- Avoid surprises. Plan for several outcomes by adjusting the repayment calculator and covering all your bases. See how different factors can affect your monthly repayments.

- Make it easier to find the best loan option. Compare loans from multiple lenders and see for yourself how the cost of the repayments differs. You don’t need to bust out your calculator, just go to the car finance calculator here.

It never hurts to be prepared. With the car loan calculator, you can put your best financial foot forward before your big car purchase.

What factors affect the car loan calculator?

While computing your car loan repayment estimates, you’ll have to factor in the variables below which will affect the overall cost of your car loan. Keep these in mind while you’re considering your loan options:

Interest rate

The interest rate is the amount of interest you’ll be charged on your car loan repayments. This is in addition to the principal amount you’ve borrowed. Any change in the interest rate will affect the total cost of your loan. Interest rates typically vary from loan to loan and lender to lender.

Loan term

The loan term refers to the time it takes for you to pay off the loan. For car loans, the duration of the loan term usually falls between two to seven years.

Car loans with shorter loan terms will generally have higher monthly repayments, but you'll pay less in interest for the duration of the loan. The opposite is true for car loans with longer loan terms. Generally, the longer the loan term is, the more interest you pay on the life of the loan.

Deposit/Trade-in

The deposit or the trade-in value of your car will affect your monthly loan repayments. The bigger your initial deposit or trade-in value is, the less money you have to borrow from the lender which means lower monthly repayments altogether.

Additional fees

Other factors that could affect the cost of your monthly repayments include ongoing costs, annual fees, stamp duty, and more. The additional fees could affect the cost of your car loan significantly. Always discuss the breakdown of your loan fees with your lender. If you want a more accurate way to compare loans, look at their comparison rates.

Balloon payment

A balloon payment is a lump sum you pay after the duration of your loan term. Getting a car loan with a balloon payment can decrease your monthly repayments. However, you will have to pay the agreed-upon balloon payment amount at the end of your loan. Follow our articke to learn more about balloon payments.

Get a low-rate car loan with Aussie Car Loans

Want a hassle-free way to get the best car loan? At Aussie Car Loans, we help you find low-rate car loans that suit your needs. Contact us today by calling 1300 889 669 or get a quick quote and we’ll get back to you as soon as possible.

Need a different vehicle finance calculator?

If you’re looking for other vehicle loans, we’ve got you covered. Check out our bike loan calculator, leisure loan calculator, and boat loan calculator.

FAQ

A car loan calculator only provides an estimate or approximation of your monthly car loan repayments. It relies on data you input and isn’t equivalent to a quote or pre-application approval. A car loan calculator is there to provide an estimate of what your car loan repayments may look like.

A car loan calculator is an easy way for you to estimate your monthly car loan repayments. This handy tool can help you budget more efficiently, compare loan options, and figure out which car loan is best for you.

A balloon payment is a sum of money paid at the end of a loan term. A car loan with a balloon payment may have lower monthly repayments.

You can use a car loan calculator when buying a used car. As long as you enter the right information, you’ll be able to get an estimate on your monthly loan repayments for your used car purchase.

You may use the car loan calculator to figure out which loan option is best for your needs. Using the car loan calculator, you can figure out which lender provides the ideal loan for your situation and negotiate accordingly.

A car loan calculator can show you an estimate of the total cost of your loan including interest. You will have to input the interest rate on the loan calculator to provide you with the proper repayment estimate.