Apply For A Low Rate Car Loan With Aussie

Whether it’s for personal or business use, Aussie Car Loans will get you a great deal on car finance with a loan individually tailored to you. Celebrating over 30 years in the industry, Aussie Car Loans offer competitive fixed rates for new or used cars, with a fast and simple online loan application and flexible loan terms.

Car Loans For You

Aussie Car Loans provide competitive low rates on personal car finance with an easy online application. We can finance any vehicle, new or used, private or through a dealership, with pre-approved loans available. Apply online for a secured, low rate loan and get conditionally approved in minutes.

Car Loans For Business

Whether it’s a new work ute, company car or fleet, Aussie Car Loans are the commercial car finance specialists and can structure a lending solution that matches the needs of your business. Chattel mortgage, novated leases, hire purchase and standard lease options are available.

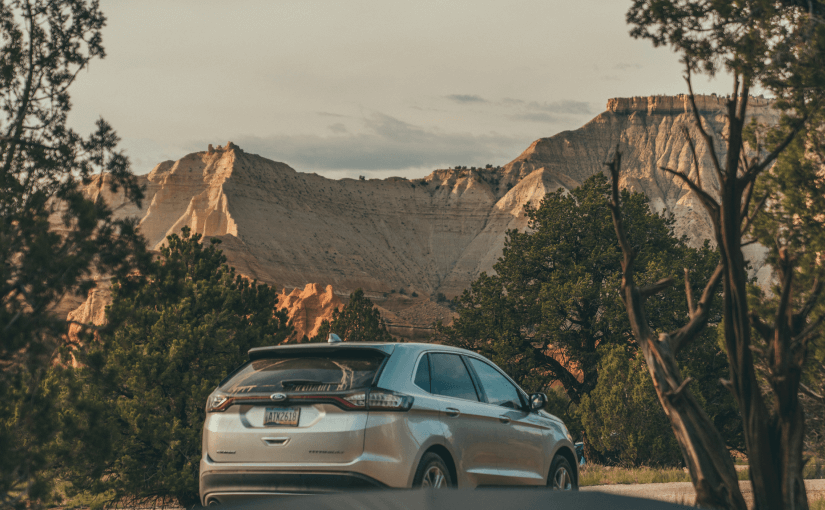

Are you in the market for a new vehicle?

At aussiecarloans.com.au, we've helped thousands of Australians get the right loan for their next vehicle.

Why choose us

Low Interest Rates

Select from among the lowest interest rates in the Australian market today

Fast approval

Our trained consultants will structure your finance for fast approval and minimal red tape

Reputable Australian Lenders

Choose leading finance products from our select panel of reputable Australian lenders

100%, NO-Deposit finance available

No deposit? No problem! We can help you finance the total amount for your new vehicle

You´re in complete control

We put you in the driver’s seat. You choose the car finance that suits you best

Flexible structure & terms

Terms from 12 to 84 months with fortnightly or monthly repayment options

Brands we work with

Questions? We can help.